south dakota excise tax on vehicles

Iowa Sales Tax on Car Purchases. All vehicles 10 model years or newer are taxed regardless of the purchase price.

Motor Vehicles Sales Amp Repair State Of South Dakota

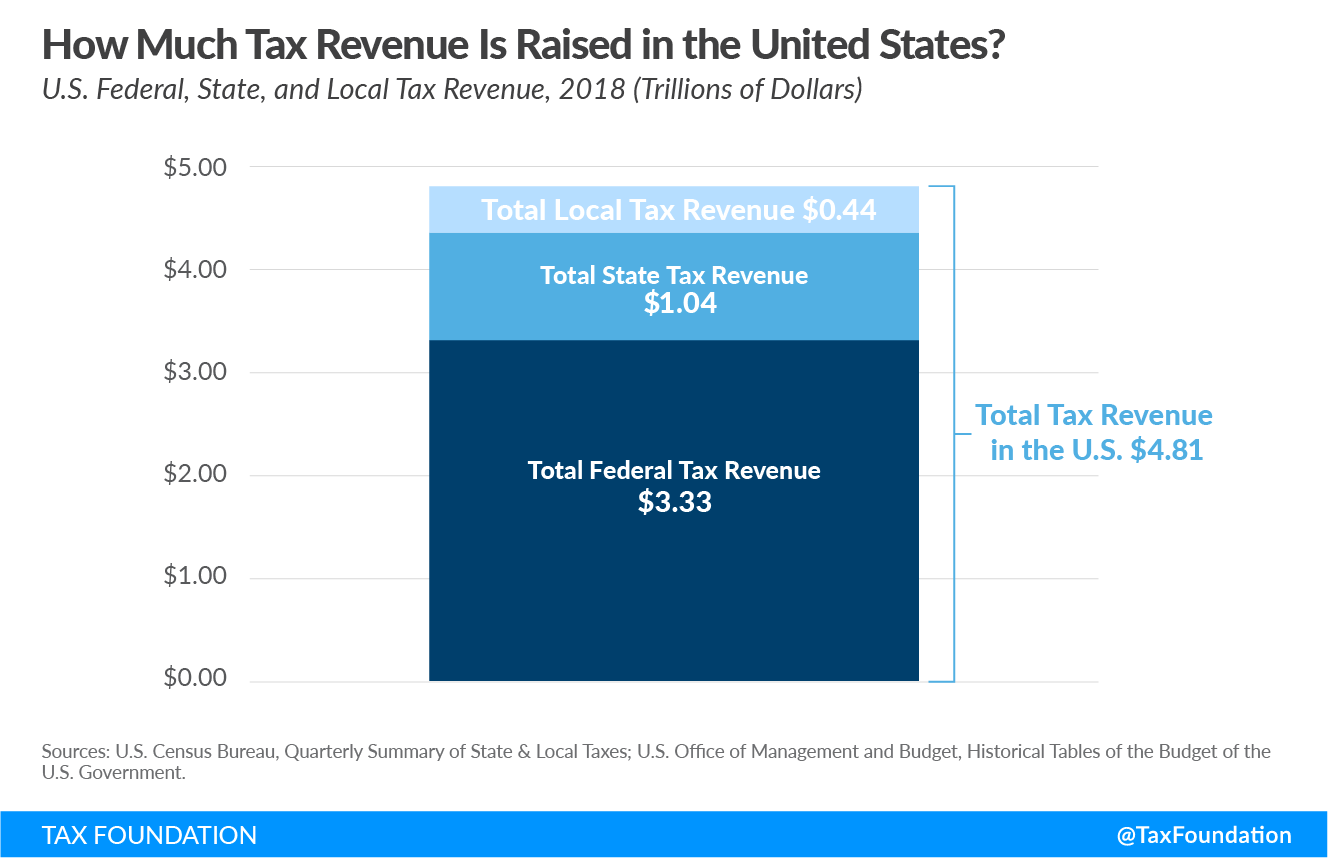

There are also local taxes up to 1 which will vary depending on region.

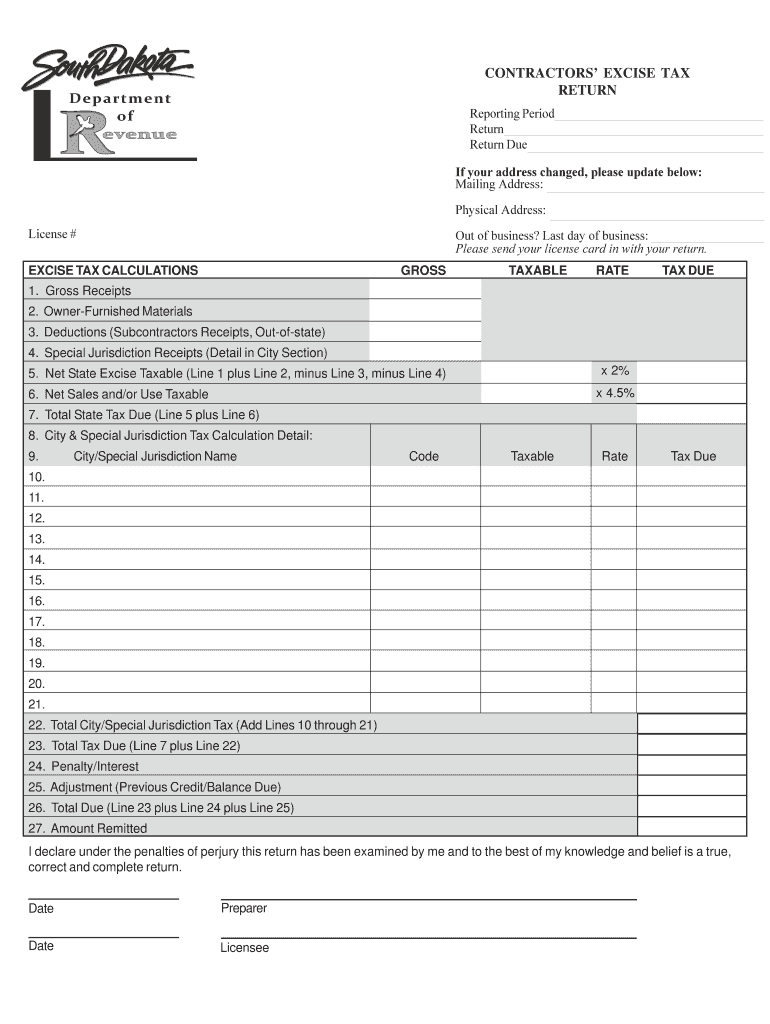

. Everything you need to know about games licensing and beneficiaries of the South Dakota Lottery. Contractors excise tax is imposed on the gross receipts of all prime contractors engaged in construction services or realty improvement projects in South Dakota SDCL 10-46A. For these projects it is important to understand the responsibilities of both the prime contractor and subcontractor.

A 4 excise tax is imposed on most motor vehicle transactions unless they qualify for an exemption. This page covers the most important aspects of Iowas sales tax with respects to vehicle purchases. The tax is based on the purchase price of the motor vehicle listed on the bill of sale purchase order or sales contract.

In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. For vehicles that are being rented or leased see see taxation of leases and rentals. Vehicles purchases are some of the largest sales commonly made in Iowa which means that they can lead to a hefty sales tax bill.

All Vehicles - Title Fees Registration. Find information about the South Dakota Commission on Gaming laws regulations and the seven types of gaming licenses issued to the general public. The gross receipts would include the tax collected from the consumer.

Vehicles which are 11 or more model years old may be exempt from the. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

What Is A Freight Broker Bond Bond Insurance Agent Youtube Videos

Car Tax By State Usa Manual Car Sales Tax Calculator

Contractors Be Sure To Get Your Dor Supplies Before You Begin Your Project South Dakota Department Of Revenue

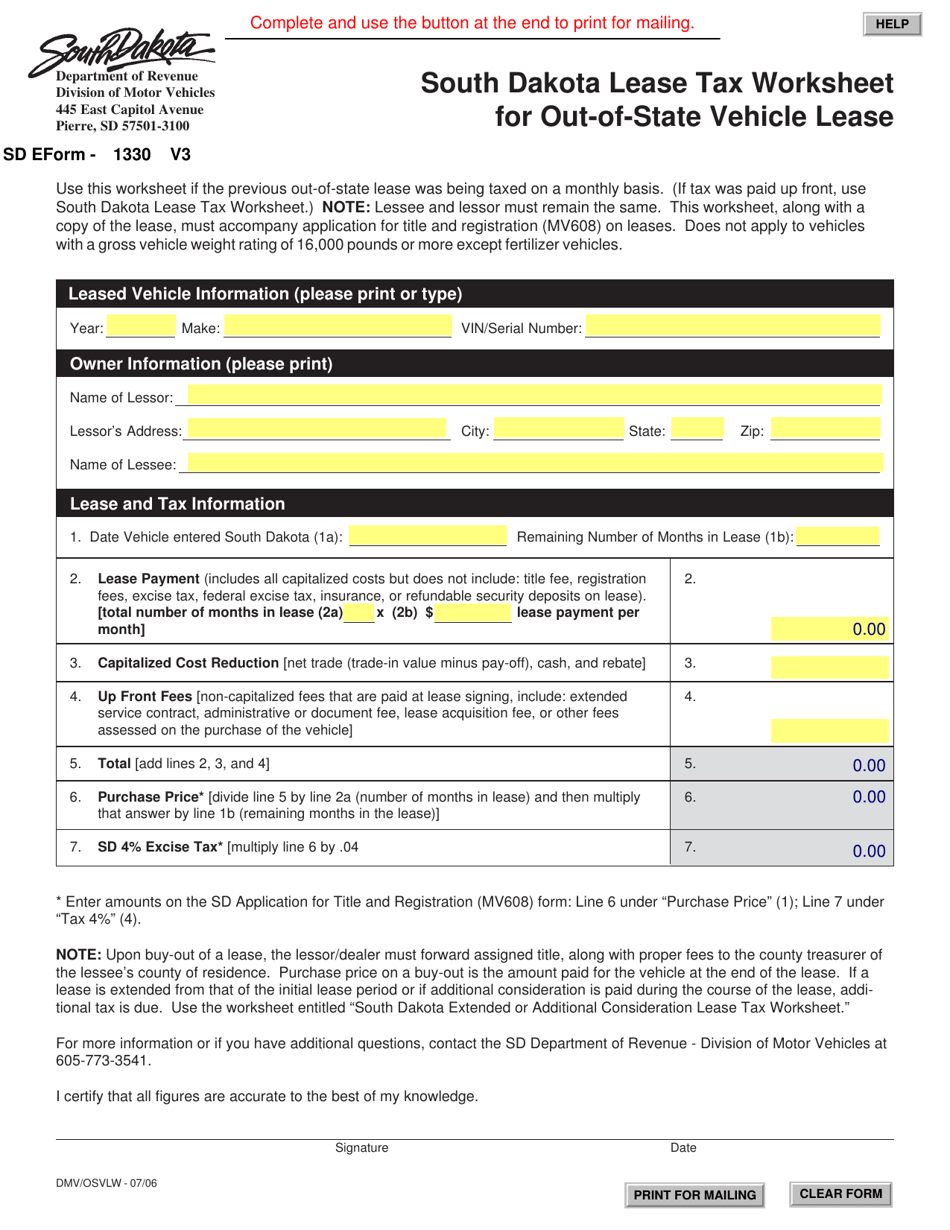

Sd Form 1330 Download Fillable Pdf Or Fill Online South Dakota Lease Tax Worksheet For Out Of State Vehicle Lease South Dakota Templateroller

1928 Chrysler Imperial Series 80 Chrysler Imperial Chrysler Imperial

Tax Compliance And Initiatives What Is Tax Compliance

South Dakota Sales Tax Small Business Guide Truic

4 Reasons A Transaction May Be Exempt From South Dakota Sales Tax South Dakota Department Of Revenue

Sales Tax On Cars And Vehicles In South Dakota

How Is Tax Liability Calculated Common Tax Questions Answered

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Finance Investing Infographic Math Review

Car Tax By State Usa Manual Car Sales Tax Calculator

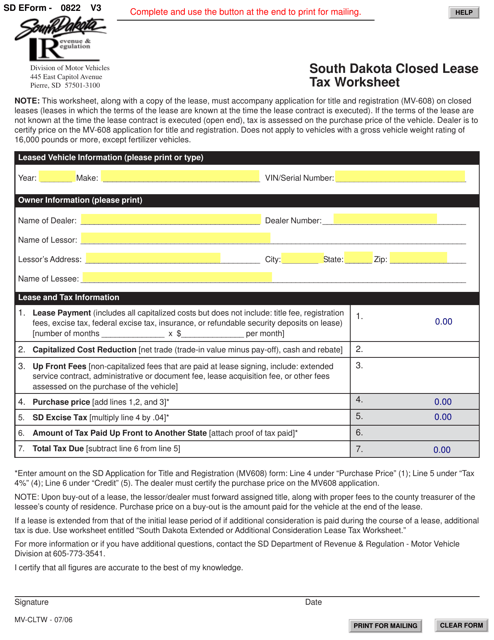

Sd Form 0822 Mv Cltw Download Fillable Pdf Or Fill Online South Dakota Closed Lease Tax Worksheet South Dakota Templateroller

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

Motor Fuels Taxes Diesel Technology Forum

Sd Contractor S Excise Tax Return Formerly Rv 011 Fill Out Tax Template Online Us Legal Forms