can you go to jail for not filing taxes reddit

A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to evading his income taxes and now must serve 57 months in jail. Talk to an accountant.

What Happens If You Don T Disclose Crypto Activity This Tax Season

The tax attorneys at The W Tax Group can help you navigate the tax code.

. But during that year I literally. If you were making 11 an hour you probably owe very little taxes. For most tax evasion violations the government has a time limit to file criminal charges against you.

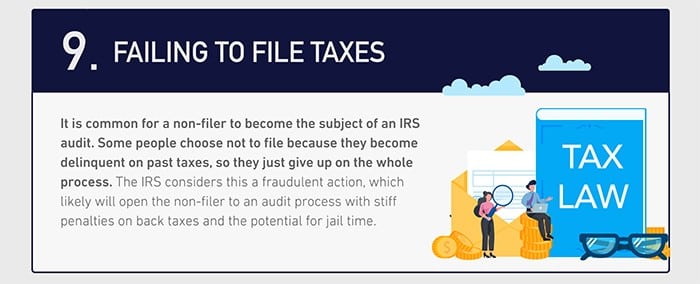

The IRS Saves Criminal Prosecution for Exceptional Cases. You claim more dependents than you have or you fail to file your return altogether you may face jail time. The short answer is maybe.

Under the Internal Revenue Code 7201 any willful attempt to evade taxes can be punished by up to 5 years in prison and 250000 in fines. If the IRS thinks you are evading your taxes by either intentionally filling out your return incorrectly ex. They must repay the taxes with an expensive fraud penalty and possibly face jail time of.

You can go to jail for failure to file or failure to file accurately but not for failure to pay. The short answer to the question of whether you can go to jail for not paying taxes is yes. In fact even an audit is highly unlikely to land you in jail.

The numbers and what you need to do are totally subjective at this point. In fact you could be jailed up to one year for each year that you fail to file a federal tax return. Plus you may be able to use your business losses to reduce your tax burden Im just speculating.

Finally the IRS may have you jailed if you fail to file a tax return. Further it does not start in most cases until you actually file the missing returns. Ballpark is it looks like it could be about 25-35k bad.

Not being able to pay your tax bill. If you dont file federal taxes youll be slapped with a penalty fine of 5 of your tax debt per month that theyre late capping at 25 in addition to. The United States doesnt just throw people into jail because they cant afford to pay their taxes.

Owing a correctly reported balance due will get you a world of penalties interest tax liens and levies but not incarcerated. Whether a person would actually go to jail for not paying their taxes depends upon all the details of their individual tax circumstances. He wont go to jail but he will be dinged with some mighty hefty penalties and interest.

After that collection calls begin. Moral of the Story. As reported by the Department Of Justice in a press release from 2009 through 2016 Daryl Brown received taxable income but did not file tax returns reporting his income or.

Beware this can happen to you. While the IRS does not pursue criminal tax evasion cases for many people the penalty for those who are caught is harsh. The short answer is.

Talk to a CPA. You could contact the Service at 1-800-829-1040 M - F 7am - 7pm although if you havent filed since 2001 it is unlikely a CSR would be able to. Yes plenty of people go to jail for not paying taxes but whether it is likely to happen depends on a lot of circumstances.

Which translates to 500 a month to the IRS for the next 6 years bad. However you cant go to jail for not having enough money to pay your taxes. Press J to jump to the feed.

You might be able to make it right before the IRS even notices. Making an honest mistake on your. In the situation you describe jail would not be an option.

They may garnish your wages and get their money back that way. If you owe more than you can afford the IRS will work out a payment plan or possibly even an Offer in Compromise. There was only 1 year that I didnt file my taxes and it was during the hay-day of my ignorance about finances.

Press J to jump to the feed. But you cant be sent to jail if you dont have enough money to pay. You arent going to go to jail but yes you should file an amended tax return.

Actively avoiding taxes out of protest definitely increases those odds. To better understand these distinctions take a closer look at when you risk jail time for failing to pay your taxes. Youre not going to go to jail dude.

Sometimes people make errors on their tax returns or are negligent in filing but they are not intentionally. They may sieze and sell your property personal and real to get their gelt. In these cases you can expect a minimum penalty of 20 of the unpaid tax and in some cases as much as 75.

This penalty applies if you intentionally disregard IRS rules and regulations when filing your taxes. There are three main civil penalties you might face if you fail an IRS audit. If you cannot afford to pay your taxes the IRS will not send you to jail.

You may even face wage garnishment or property seizure. However the government has plenty of recourse left. This may have you wondering can you go to jail for not paying taxes.

You can go to jail for not filing your taxes. However you can face jail time if you commit tax evasion or fraud. The short answer is maybe it depends on why youre not paying your taxes.

It depends on the situation. Essentially this lets you haggle for a. Oftentimes youll be subject to tax penalties which will run you a pretty penny at up to 50 of your unpaid tax amount.

Yes but only in very specific situations. Tax evasion results in up to five years while failure to file your return will give you one year in prison for every year you do not file. You can go to jail for lying on your tax return.

With this in mind you should also remember that the statute of limitations for tax evasion and failure to file can last as long as six years. Unpaid taxes arent great from the IRSs perspective. If he doesnt pay up then CRA can seize bank accounts and put liens on his property.

Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen. Press question mark to learn the rest of the keyboard shortcuts. Jail time is usually reserved for those who criminally evade taxes.

When I was working in a Tax Clinic we had plenty of people that had not bothered filing for 10 years that had not gone to jail but did owe tons more money than their original liability because of. There is not enough detail in your post to tell you how bad it is.

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

2022 Tax Return How To Factor In Your Child Tax Credit And Covid Costs Npr

How To File Overdue Taxes Moneysense

Irs Tax Audits How Likely How To Handle Them David Klasing

Irs Whistleblower Program Get A Reward For Reporting Tax Fraud

9 Red Flags That Could Trigger A Tax Audit Wtop News

Category Tax Tips For Non Residents Sprintax Blog

Common Irs Audit Triggers Bloomberg Tax

How To Complete The Fafsa If Your Parents Didn T File Their Taxes Student Loan Hero

No It S Not Your Money Why Taxation Isn T Theft Tax Justice Network

Government You Owe Us Money It S Called Taxes Me How Much Do I Owe Gov T You Have To Figure That Out Me Ijust Pay What I Want Gov T Oh No We Know

Thoughts I Ll Probably Deactivate My Listings 12 31 21 Not About To Pay Taxes On Stuff I Ve Already Paid Taxes On Especially When It S Just Stuff I M Just Trying To Get Rid Off And

Consequences Of Being A Us Citizen Living Abroad Not Filing Taxes